The aloha spirit returned to Honolulu, Hawaii, as delegates arrived in full force from all over the world to connect at the 44th installment of the Pacific Telecommunications Council’s (PTC) Annual Conference.

There was a real buzz in the air this year as PTC’22 attendees were reunited once again in person and virtually! The industry has evolved at such a fast rate while it has helped keep the world connected during the COVID-19 pandemic so there was a lot to catch up on!

This year’s theme: Reunite. Rethink. Renew. rang true throughout the entire week but was embodied in the Power Women Breakfast Series sponsored by Verizon on the subject of diversity and inclusion (D&I).

Oracle’s Lynn Smullen and 26FIVE’s Sophie Ann Terrisse deep dived into the subject and spoke passionately about reuniting and re-engaging people on this critical topic. Equity was highlighted as an important step to take D&I further as it promotes fair treatment and access to opportunities, while working on eliminating barriers and unconscious bias were also highlighted. Smullen asked: “What fosters innovation?”

“Creativity,” Terrisse responded. They both explained how this can only be truly realized with diversity, which in turn comes from the creation of inclusive environments. Recognizing, respecting, and encouraging our differences and individualities will be a huge step in fostering true innovation.

Investing in mentorship, coaching, and allyship are huge areas that will help us to rethink and empower change. Two great initiatives seen at PTC this year were NJFX’s Millennials in Telecom Reception again and the launch of an Inclusion Hub, a mentor networking event powered by iBASIS, HOT TELECOM, and 26FIVE. The latter provided PTC’s young attendees with the opportunity to network, engage, and build relationships with senior executives in the industry. These are welcome additions alongside PTC’s ongoing Young Scholar Program and PTC Academy.

M&A Activity and Infrastructure Funds

M&A Activity and Infrastructure Funds

It’s not just young players that are entering the industry. Other players are emerging and entering the market from start-ups and innovative disruptors to infrastructure funds.

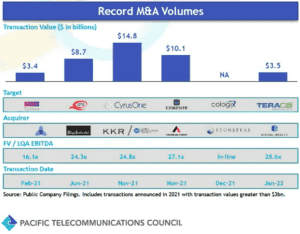

Investment in digital infrastructure has never been higher, said Alexander Ramirez, managing director in the global communications investment banking group at Citi, who highlighted how 2021 was the most active year in data center M&A activity, with the six largest transactions representing nearly USD 50 billion of transactional value.

Madonna Park, managing director and global head of communications infrastructure at RBC Capital Markets, said in another session: “Today, the infrastructure funds have completely displaced all the private equity funds. We’ve also seen a lot of the sovereign wealth and pension funds look to make more direct investments in the space. A large pool of capital has entered the market looking for opportunities to invest. Fundamental growth drivers, whether cloud or 5G, the underlying trends are the same but an industry like towers is more mature at the end of the day and more understood. Data center and fiber components are equally critical to global connectivity.”

One of the foremost leaders and luminaries in the digital infrastructure ecosystem today: Marc Ganzi, president and CEO of DigitalBridge, provided the opening center stage session on Monday morning.

Several executives had said throughout this year’s show that investors and infrastructure funds are having a calming effect on the ICT industry today. They are not only helping to fund the builds and investments of tomorrow, but they also bring with them a holistic view that perhaps is needed as many parts of the ICT food chain remain too focused on their layer with blinkers on or remain in “one swim lane,” as Ganzi put it in his keynote. It was fascinating to hear what one of the biggest digital infrastructure players is doing, what defines the edge today, and how they see the industry coming together in a hyperconverged ecosystem.

Digital transformation is being enabled by the cloud. The use of cloud computing services and applications has increased at a rapid rate and has led to the rise of hyperscale data centers. “There’s USD 1.3 trillion of global data center capex being spent right now. It is absolutely stunning,” Ganzi said. “All of you will experience that in your meetings at PTC talking to customers, competitors, suppliers.”

Ganzi explained why he and everyone at PTC should be really excited about the massive demand trends for global connectivity in our sector today. He said that it was so transformational and that in his three decades within the industry, this is one of the most exciting eras for digital infrastructure.

It’s really simple, he said: “The old way of investing and building digital infrastructure was a very siloed and myopic approach to investing.” You had to be captive in one swim lane whether it was tower, data center, fiber, or small cell infrastructure that was really oriented at mobile networks and enterprise compute. “Today, the world is changing. It was changing pre-pandemic, it’s forever changed in the midstream of the pandemic, and it will continue to change post-pandemic.”

“The entire ecosystem is growing. We believe over USD 400 billion of annual capex will be needed to meet the demands of future network infrastructure,” he said. “This is in connection with mobile, cloud, enterprise colocation, and edge capex, as well as fiber, small cells, and other forms of digital infrastructure investment. It’s a massive opportunity for everyone in the room at PTC and watching.”

5G: Where Mobility and Cloud Collide

5G is very exciting and Ganzi believes it will be the first time where mobility and cloud will collide. “Demand for connectivity is driving that need for significant, persistent investment in digital infrastructure. Mobile data traffic will continue to grow through the advent of 5G networks. Putting those applications and enabling them in a software-defined environment will only increase mobile network data traffic,” he said. “We believe that will increase fivefold over the next few years.”

DigitalBridge sees mobile capex as persistent and long over the next five years and adds that “5G will be an eight-year build.”

“We’ve just started building 5G in 2021, so by 2028, 5G networks will be about 90% penetrated and built. This is almost USD 1 trillion of capex.”

In Ganzi’s session, he said he was very excited about 5G and explained how it’s a radical shift in network topology and requires converged solutions. “We’re estimating that there’s USD 1.1 trillion of capex that is in the process of being spent right now (2020-2025) to build 5G networks,” he said. “It will be the lowest latency, fastest mobile network we’ve ever built but it requires massive densification, macros and fiber infrastructure that’s all fed not from a backhaul architecture but really in a software-defined environment where we’re fronthauling network infrastructure for the first time. You can’t just build a 5G network with macro towers and put base stations at the bottom of those towers, it’s a lot more complicated.”

ORAN and CRAN solutions are driven from the data center, Ganzi explained, from a hub and spoke network that is fronthauled from that RAN architecture through dark fiber out to small cell, Wi-Fi, and macro infrastructure. “It’s literally the test of the entire digital infrastructure ecosystem,” he declared.

The proliferation of IoT devices will only help reposition compute and applications. “We’re moving from a world where we have 20 to 30 billion connections (2020), to 500 billion connected devices by 2030. It’s a hyperconverged environment and you have to understand network topology, architecture, your customers, where they’re going, and how do you execute for them,” Ganzi said. “We’re building those next-generation of networks to serve a highly converged ecosystem.”

Network demands will continue to shift through the next decade and 5G is the opportunity to marry mobile infrastructure with applications. Most of the data center owners and builders are building for applications and services providers that are enabling the next-generation of AI. The Internet of Things is very much tied to where 5G infrastructure is going, Ganzi added. “IoT adoption is one of the key areas we believe will drive the next wave of edge infrastructure and fuel capacity,” Ganzi stated.

Edge Infrastructure: The Next Wave

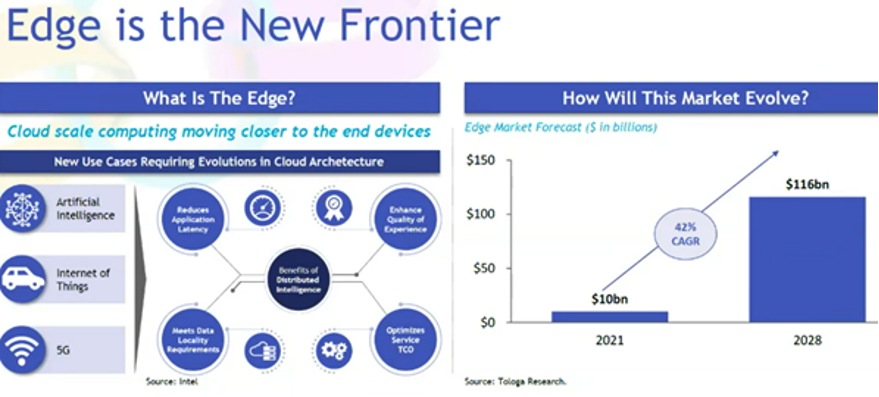

There’s much confusion around “the edge” and what is essentially a “smart data center,” said Raul Martynek, CEO of DataBank, in the Cloud at the Edge panel. “One definition is cloud-scale computing which is moving closer to the end devices.” Raul added that a succinct definition of edge is: “The recentralization of how applications are hosted.”

The ecosystem has transferred into a biosphere and the autonomous age is the edge, said Joseph Reele, vice president of solution architects at Schneider Electric. “Data centers can become a bigger fabric of our country and edge is the requirement to enable that. But what is the edge and what is it good for? Edge is the enabler for the world’s biggest things and is the new frontier of how cloud-scale computing is moving closer to the end devices,” he said.

What does this mean from a market demand and growth side? “Growth in the edge market industry will be massive, growing from USD 10 billion in 2021 with a 42% CAGR to USD 116 billion by 2028,” Citi’s Alexander Ramirez said in another panel citing Tolaga Research.

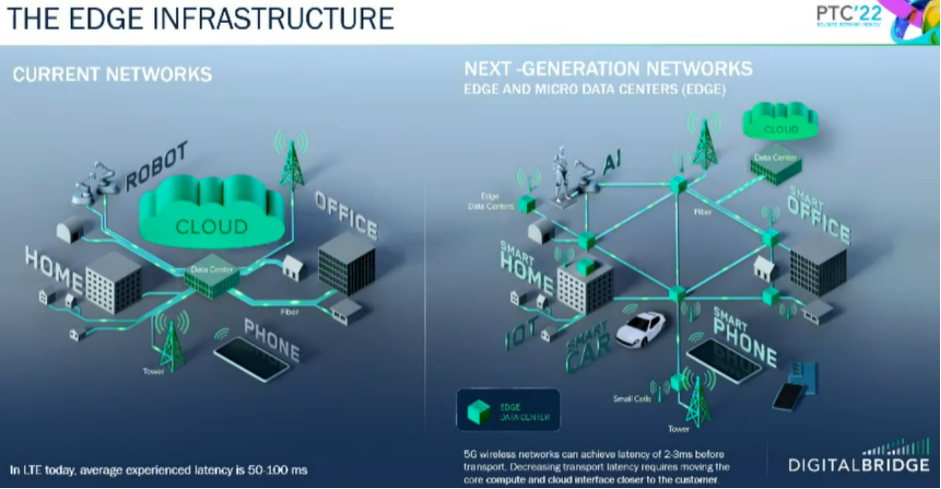

Ganzi explained that the next-generation network is a “5G-evolved ecosystem, which is much more converged using edge and micro data centers, getting down to 2-3ms of latency before transport.” Decreasing transport latency requires moving the core compute and cloud interface closer to the customer. Edge data centers aren’t just your typical facilities, Ganzi stated, for example, “make no mistake, a radio access network hub is an edge data center today.”

Ganzi explained that the next-generation network is a “5G-evolved ecosystem, which is much more converged using edge and micro data centers, getting down to 2-3ms of latency before transport.” Decreasing transport latency requires moving the core compute and cloud interface closer to the customer. Edge data centers aren’t just your typical facilities, Ganzi stated, for example, “make no mistake, a radio access network hub is an edge data center today.”

“Think about the network elements that are required to build a RAN hub: dedicated power, backup power, cooling, raised floors, backup cooling, security, dense fiber. Boy, that sounds a lot like a data center.”

“Every year till 2026, there will be a consistent USD 200 billion spend by customers in hyperscale, edge infrastructure, and redefining what enterprise colocation really means,” Ganzi declared. “Edge infrastructure is really about addressing customers’ needs at the parameter of their networks. It’s not just about data centers. It’s about fiber networks, it involves cell towers, small cell network architecture as well.”

“Every year till 2026, there will be a consistent USD 200 billion spend by customers in hyperscale, edge infrastructure, and redefining what enterprise colocation really means,” Ganzi declared. “Edge infrastructure is really about addressing customers’ needs at the parameter of their networks. It’s not just about data centers. It’s about fiber networks, it involves cell towers, small cell network architecture as well.”

To make that all work, you not only need the fiber, antennas, and devices themselves – you need the network intelligence at the edge, he continued. “We believe that 1.6 million servers will move to the edge over the next six years, representing 10% of cloud workloads. While most of these big workloads will sit in the AZs in the large areas where we’re building hyperscale campuses, a significant chunk of that network intelligence will sit at the edge. We think this is one of the great trends that’s fuelling the early innings of 5G and edge computing.”

Subsea and Satellite

Discussions during the PTC’22 submarine cable workshops and submarine cable luncheon sponsored by SubOptic, were incredibly informative and included a thought-provoking panel, TeleGeography’s insightful research and forecasts, and regional updates on the submarine cable markets. It’s also very clear to see that a whole host of new investors have entered the industry as they see the growing need in the space and seek steady returns. Infrastructure funds are also starting to look at other areas and expand their digital infrastructure portfolios.

A diverse set of expert panellists from around the globe were assembled to share their perspectives on the challenges the subsea market is facing today. Discussions were led by Elaine Stafford, managing partner, DRG Undersea Consulting, and each of the panellists discussed the variety of issues the industry currently faces, including: continued pressure to expand capabilities to meet growing record demand for new cables, strains on cables retiring due to age or not being economically viable, cost pressures on builds and maintenance and also how to deliver, supply chain impacts, and operate and maintain systems in an increasingly environmentally-friendly manner.

Regulatory, licensing, and permitting changes all “remain outside our collective spheres of influence,” Stafford added while citing an earlier reference from one of the panellists: “It’s somewhat aspirational to imagine we have the collective will and capability to either self-regulate or have a dramatic influence on global geopolitics.”

Marc Halbfinger, COO of Console Connect by PCCW Global, spoke poignantly and addressed one issue head on: “Is the separation of assets driving fragmentation or disintermediation of the industry? Or are we all ultimately driving for common requirements?” The industry certainly does collaborate and come together. Just look at the mixed subsea cable panel that Halbfinger was speaking on.

Subsea cables are part of the ICT food chain but there are of course different vectors and shareholder pressures. “Different entities involved in delivering ICT services and apps have different interests, which draw different economics and therefore leads to challenges,” he said.

Although there are lots of exciting projects where more collaboration is being witnessed. For example, Facebook/Meta is working well with service providers on the 2Africa project and “when we get to this point of this collaboration it’s advantageous.” Halbfinger highlighted one industry move that was good for diversification by pointing out Equinix’s recent acquisition of MainOne. “It’s interesting not just for its data centers but subsea cable networks and I’m hopeful that will lead to greater integration as opposed to separation of assets.”

Ecosystems have grown so rapidly to meet demand that a natural fragmentation has occurred and less focus on interoperability as a result. “Without having technical interoperability, driven by a common set of ideas around commercial interoperability, we’ll have continued fragmentation and disintermediation,” Halbfinger said. “If we can facilitate interoperability of infrastructure, this can lead to competition, increase value, but at the same time find a roadmap to increased interoperability among the very diverse units that deliver ICT today.”

Nigel Bayliff, CEO of Aqua Comms, agreed and said that despite there not being a big telecoms global regulator enforcing rules, industry discussions and the work the ITU is doing around formulating ideas and standards for interoperability will help us to foster interoperability. “We should all recommend interoperability to help bind layers above and below so we can rely on each other to achieve our global goal of allowing people and machines to communicate in an efficient, effective, and well-priced way.”

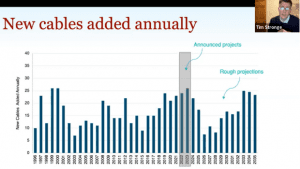

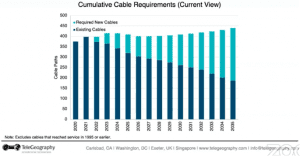

TeleGeography Workshop

TeleGeography’s spot on the PTC Annual Conference agenda is becoming known as an essential source of market research that attendees shouldn’t miss. This year’s workshop with Tim Stronge, vice president of research at TeleGeography, really stood out. He first looked at how OTTs, hyperscalers, and CDNs were driving international bandwidth demand today. “In 2010, they accounted for only 6.4% of all international bandwidth usage,” he said. “It looks like that will be around 68% today.” The contribution of content and cloud providers’ capex to help build new submarine cables has surged in every region. Stronge explained how from 2015 to 2019, the contribution was around 56% in the trans-Atlantic but this has now grown to around 90%. It has also jumped from 11% to 70% for Pacific builds.

TeleGeography’s spot on the PTC Annual Conference agenda is becoming known as an essential source of market research that attendees shouldn’t miss. This year’s workshop with Tim Stronge, vice president of research at TeleGeography, really stood out. He first looked at how OTTs, hyperscalers, and CDNs were driving international bandwidth demand today. “In 2010, they accounted for only 6.4% of all international bandwidth usage,” he said. “It looks like that will be around 68% today.” The contribution of content and cloud providers’ capex to help build new submarine cables has surged in every region. Stronge explained how from 2015 to 2019, the contribution was around 56% in the trans-Atlantic but this has now grown to around 90%. It has also jumped from 11% to 70% for Pacific builds.

The growth rate in demand has been very high in most regions over the past five years. However, it’s clear that the cable buildout boom is on hold for now and upgrading is taking more time. “One thing that is definitely happening is that there is a temporary supply constraint, with a shortage in computer chips, and a 20 to 25-month wait on 100G cards.”

In its PTC’20 workshop, TeleGeography had shown the growth rate in trans-Atlantic demand over the previous five years was 50-70% and forecast a rate of 40-60% up until 2027. Although the final 2021 figures are not confirmed and are subject to change, Stronge said that it looks like their initial estimate of growth in 2021 of 44% will in fact have dropped to 23%. He explained that the forecast looks like it will rebound and rise to just over 30% and flatline until 2027.

In its PTC’20 workshop, TeleGeography had shown the growth rate in trans-Atlantic demand over the previous five years was 50-70% and forecast a rate of 40-60% up until 2027. Although the final 2021 figures are not confirmed and are subject to change, Stronge said that it looks like their initial estimate of growth in 2021 of 44% will in fact have dropped to 23%. He explained that the forecast looks like it will rebound and rise to just over 30% and flatline until 2027.

Submarine Cable: Regional Updates

The first executive to provide a subsea regional update was Mike Constable, chief executive and board director of HMN Technologies, who explained how the APAC region was experiencing robust demand in both investment and lighting existing bandwidth. “Over the past decade or so, there’s been a 55% CAGR of lit bandwidth in the trans-Pacific and intra-Asia region.” He said the region was seeing investment coming in from data center players for the first time. “If you look at just some of the trans-Pacific systems on their own that have been announced recently, they’re adding 500TB of new trans-Pacific capacity. That’s a significant number. Looking at over 130,000km of systems that are either planned or actively under deployment now,” he added. “Historically, many years ago, the average km invested globally used to float around 80,000-110,000km. Today, we’re seeing that figure in the trans-Pacific and intra-Asia region alone.”

Mike Rieger, vice president of sales and marketing at SubCom, explained how there is capacity growth of 35% CAGR year-on-year in the Middle East and Indian Ocean region. It’s becoming an increasingly important route connecting APAC to Europe, complementing the route via the U.S. With around 2 billion people, the region has a wealth of cable diversity as well as hubs and meet-me points, most notably in Egypt, Djibouti, and Oman.

“The Latam market is growing at a 42% CAGR since 2018,” said Erick Contag, executive chairman of GlobeNet. In the early 2000s, there were only three large systems in the region. Since 2017, 13 new cable systems have been established in the Latam market that are either reaching new markets or complementing existing systems. Cables that have boosted intercontinental connectivity with Latam include Angola Cables with Africa. Erick admitted two projects that he was enthused about. The first is the Humboldt Cable Project, which will connect Asia with Chile. The second is already in execution. “Norte Conectado is the development of a river-based subsea communications network and radio access that will service northern Brazil and neighboring countries (Colombia, Peru, French Guiana). It will provide Internet to 9 million people in 59 municipalities and is a great backup to existing terrestrial telecoms infrastructure,” Contag added.

Over to the European subsea market, Philippe Dumont, CEO of EllaLink, provided an update on its 5,900km subsea cable between Fortaleza, Brazil, to Sines, Portugal. There are significant connections on the route, with extensions to São Paulo and Marseille, along with branches on the route. “Morocco will be added later this year,” he said. “100Tbps is connecting the two continents together.”

Funke Opeke, founder and CEO of MainOne, explained that despite Africa being one of the least connected continents, it is one of the fastest growing in terms of the number of users gaining access to the Internet. “4G penetration in the region is under 50%, but mobile data growth will drive the market,” she said. “Global players are wanting to close that geographical gap in their portfolios with a footprint in Africa and are committing considerable amounts of capital on the continent. Driven by the growth that we’re seeing and the youthful population and demand. From having just one cable system at the turn of the century, the continent now has close to 10 cable systems, serving both the west and east coasts.” Funke highlighted the two massive continental systems being planned: Equiano (2022) championed by Google, running down the west coast, and 2Africa (2023), championed by Facebook/Meta. “Both cable sponsors are bringing in other players to take interest in the continent and are really helping to change the dynamic of the continent.”

Funke spoke briefly about Equinix’s acquisition, announced two months prior and valued at USD 320 million, of the company she founded in 2010. Equinix has entered the African continent through the acquisition of MainOne, which has an array of digital infrastructure assets including three operational data centers, soon to be four with a total of over 64,000 square feet, a 1,200km terrestrial fiber network across Southern Nigeria, 65 points of presence (PoPs), and a 7,000km high-capacity subsea network from Lagos, Nigeria, to Seixal, Portugal.

Satellites

Opeke said the interesting challenge everyone will face on the African content is the issue of local distribution. “How do you get access to end users, how do you move all this data inland, how do you get data closer so you get the performance, while not having to have the latency from sourcing from Europe and the U.S., where round trip delays and latency can be over 100ms,” she said.

New generation satellites are helping to solve this issue to an extent, added Opeke: “We’re seeing developments with the LEO satellites, which take a different approach to the problem. They cut out the need for any additional last mile deployments since they are deploying and serving the consumers directly.”

PTC’22 had the pleasure of hearing from Vint Cerf, the “Father of the Internet,” who revealed that he’s been encouraged by the developments in both the subsea and satellite spaces. On the subsea space, he said: “Several things are happening to my great surprise and satisfaction, like the increasing amount of undersea cable that is going everywhere. High-capacity cables are being built, including by players such as Google as well.”

“Satellites have historically been used for connectivity for developing countries, but now we have LEO satellite companies, like the Starlink program that SpaceX is undertaking,” Cerf added. “What’s spectacular is the sheer magnitude of the effort. The numbers are mind boggling: 42,000 satellites, which they’ve [Starlink] obtained permission by the FCC. At some point, it may even be impossible to avoid access to the Internet, including the North and South Poles, with these satellites!”

PTC’22 played host to an array of satellite sessions, including: technical developments, GEO satellite innovations, as well as a session on how satellite solutions can help to accelerate global communications with the cloud.

Key Industry Challenges

The digital divide still exists and increasing efforts are needed to improve network access and reliability in all regions. Cerf said that “Digital Inclusion” is still an area he feels passionately about, “helping those who are unconnected to get connected to the Internet.” However, despite looking at ways to help bring people online, making sure that safety, security, privacy, and battling other harmful side effects of being connected are challenges we must face. The challenge the industry faces with keeping up with demand and the data onslaught that comes with it is a constant ongoing one. Increasing bandwidth and data, alongside an increase in remote working, proliferation of connected devices and access points, all lead to us needing to be more equipped to mitigate and tackle rising cyber criminality.

“One of the major challenges for us as an industry is how do we intend to become decarbonized within the next eight years,” Ganzi said in his keynote. “All new thinking, architecture, applied learnings, and thinking about where the source of compute is and disaggregating our storage, building in size and scale while doing the right thing for the planet.”

A huge issue the entire industry and world have faced, in particular during the COVID-19 pandemic, has been around supply chain constraints. Shortages, slower deployment times, factories being full to capacity, and less availability of ships have also caused huge challenges to the industry.

In a global data center perspectives panel, David Ferdman, interim president and CEO for CyrusOne, outlined a three-pronged strategy to how CyrusOne has coped with construction and supply chain delays: (1) multiple vendors and dual sourcing – working with many more vendors at each component; (2) longer-term procurements; and (3) working a lot closer with customers during these times.

Bill Stein, CEO of Digital Realty, said that permitting restrictions had also started to be felt. “Singapore, Amsterdam, places in EMEA, and Silicon Valley have begun tightening data center permitting to various degrees,” he said. “These restrictions impact our ability to deliver new capacity to meet customer demands in these markets. We think it’s quite possible that we’ll see similar restrictions in more regions in more markets around the world.”

Bill Barney, founder and CEO of Turbidite, identified a number of big challenges the industry faces, including geopolitical dynamics, government, and trade conflicts. “The China-U.S. trade war has already made the South China Sea a ‘no lay zone’ for U.S. cables,” he said. “16 cables have been blocked from coming into Hong Kong or transiting the South China Sea. Future supply and high-speed interconnections are at risk unless there are alternate points available into Southeast Asia.” He added: “This is probably the worst stage of diplomacy between the U.S. and China since the 1970s. In telecommunications, this becomes an issue when we start to think about 5G and how we interconnect our cables between the U.S. and Asia.”

Barney cited Sun Tzu for once saying: “He whose ranks are united in purpose will be victorious.” Today, despite the huge variety of challenges that we’re all facing, it’s clear that there are huge opportunities afoot. That can be realized with more enhanced collaboration and interoperability.

PTC’22 was certainly one for the record books in terms of quality content, insights, collaboration, and redefining strategies! It’s reignited the industry with a renewed vigour to collaborate more and enhance interoperability to Reunite. Rethink. Renew. for tomorrow’s hyperconverged ecosystem.