The PTC’20 annual Submarine Cable Workshops, and Luncheon sponsored again this year by SubOptic, was bigger, better, and more informative than ever. With over 250 attendees, the value and popularity of these workshops continues to grow!

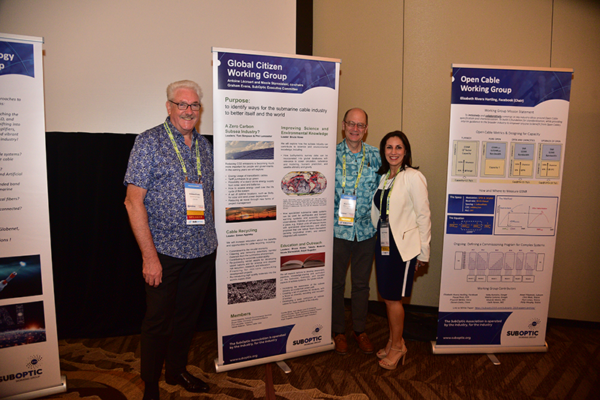

Poster Session

For the first time, the Submarine Cable Workshop included a poster session which was very well received. Several of the posters were prepared by SubOptic Working Groups, each of whom is driving a new initiative targeted at helping our industry move forward. If you were unable to attend PTC, you can review each of those posters here, along with a list of the Working Group members. On behalf of our industry as a whole, SubOptic would like to thank all of the Working Group members for their effort and contributions. Additional posters presented by the Bermuda Business Development Agency, Ciena, Corning, OSI, and the Pacific Island Community were a great preview of presentations shared at the Submarine Cable Topical Session: Real Issues! on Monday.

Unique Perspectives

The main event followed a similar program to past years, with the theme for 2020 focused on “Serving Both Large and Small Markets.” There were also many valuable take-aways from panel discussions on data center activity and global subcable development activity, with a particular focus on opportunities between large projects providing solutions for the many remotely-located smaller communities. However, one new feature was a well-received guest speaker, Robert Suber from Intelsat, providing perspective from a related industry responsible for a different form of international telecommunications.

Undersea cables, together with data centers, are unequivocally now seen as interconnected and interdependent critical infrastructure for today’s information-driven world. Their futures are not only intertwined, but they also face many of the same industry challenges, whether it be recruiting young talent, influencing regulations, attracting long-term infrastructure capital, or simply providing access to the global communications fabric. Collaboration between the two industries and between large and small markets has clearly started and is likely to increase over time. Erick Contag, president of SubOptic, led a discussion about all of these issues with a set of panelists from across both industries.

What we often overlook in the undersea business, however, is the important complementary role that satellites play as part of today’s global communication backbone – especially for the smaller, landlocked, or emerging markets. Suber provided a tutorial on how new low-orbit satellite solutions and technology advances may complement the undersea backbone. While much of the satellite industry is focused on destinations in motion (such as ships and planes), he encouraged our undersea community to explore joint cable-satellite solutions for fixed destinations, such as those with limited resiliency and/or small, remote communities with limited ability to afford a new cable.

TeleGeography Session

TeleGeography research reiterated that the demand for international communications capacity continues to grow at a healthy pace, driving the need for many new cables not only on the traditional transoceanic routes but also on new routes.

New Trends

Sunday’s panels highlighted how the increasing rate of new cable construction across the Atlantic and Pacific in recent years has clearly spread to other transoceanic and regional markets, which extend connectivity from the biggest hubs to secondary ones, especially in Northern Europe, as data center construction looks to colder climates and those with ample renewable energy. Panelists speculated that the current trend to build on new, express, and/or diverse routes (such as EllaLink, OAC, and SAEx) might finally extend to making Arctic EurAsia projects a reality. Reassuringly, none of the panelists appeared overly concerned about a couple of recent announcements of cable restructuring, which were characterized as a result of unique market circumstances, rather than an ominous sign amidst an otherwise very healthy growth curve.

As it happens each January, several new cable projects are announced publicly prior to PTC’s Annual Conference, while others continue to push closer toward reality with a strategy of staying “under the radar.” Thus, the workshop’s discussion highlighted the breadth, but not the full depth, of market plans.

Some panelists commented that cable projects seem to take longer to come into force than the market anticipates – developers and suppliers continue to be somewhat optimistic when forecasting closure dates. This is not a new phenomenon. Rather, there seems to be a market misperception that reaching closure should be simpler and thus quicker today than in the past when large consortia seemed to take many months to finalize C&MAs and supply contracts.

Challenges

It’s rare to have a panel session about cables without remarks about how cable projects seem to be taking longer to reach RFPA than planned. The historic challenges to construction feel like they’re worsening rather than getting better. Geopolitics and regulatory issues are severely impacting several projects. Kent Bressie reflected on both the licensing challenges that cables connecting the U.S. and Asia face today, as well as how ICPC efforts at the U.N. influence international policies governing seabed use by cables. The upcoming April ICPC plenary meeting in Madrid will undoubtedly shed more light on these issues and how ICPC is working to help the situation.

Summer School

This summary would not be complete without mentioning the video in which Valey Kamalov shared documenting last year’s submarine cable summer school. The program was sponsored by Google, OSA, and SubOptic, and supported by many companies through the undersea cable industry, who sent their own submarine cable experts to teach more than 50 graduate students from around the globe about submarine cable technology. This was the first of what many hope to be more educational and awareness programs. Plans are already underway for another in 2021. The program has started to bring new blood into our industry and we hope more companies will benefit from this initiative over time.

PTC’20 proved to be another important event for our undersea cable community. Those of us who worked to plan the day’s events are thankful to PTC for providing the opportunity to learn from each other and network each year. We’re also appreciative to SubOptic Association for sponsoring the event. As the Association continues to work in new ways to help the industry move forward, SubOptic hopes that it will attract a more complete roster of companies as members anxious to encourage progress. For more information on SubOptic and its membership benefits, see the SubOptic membership page.

We will continue to witness a lot of activity in the Asia-Pacific region over the next few years, starting this year as sponsors of major world sporting events roll out new technologies to support the 2020 Summer Olympics in Japan and the 2022 Winter Olympics in China. Japan will be used as a platform to transmit in 8K broadcast resolution – twice as the highest we use today– and China is expected to employ virtual reality to enhance viewers experience on-site and around the globe. Robust global communications, using our submarine cable backbone together with satellites, will provide critical transport for bringing the excitement of these games to nearly every corner of the world with unsurpassed quality.